Conditions

Information about ordering

Once you have completed your order, an order confirmation will be sent to your email address. In the confirmation, you will find all information about the products, prices, billing, and shipping address. If something is wrong with your order, don't hesitate to contact us by e-mail at hello@flowlife.com. You must be 18 years old or have a guardian's approval when ordering. The order confirmation is always sent automatically to the customer’s specified e-mail after ordering, thus ensuring that the information also comes to the customer.

Delivery

All items are shipped with DHL, and our standard delivery times are 1-5 business days. NOTE! Orders made on weekends will be sent no earlier than Monday. If delivery delays should occur (without having notified you of any longer delivery time), please contact us directly at e-mail hello@flowlife.com.

Prices

The prices in the store are stated in Euros (EUR). We reserve the right to change prices due to price changes from suppliers, field prints in the price list, and errors in prices due to incorrect information and reserve the right to adjust the price.

Shipping

We send all packages with DHL, always with free delivery & free return.

When purchasing products from our website, payment by card or invoice will only be activated when the product is shipped from our warehouse. This means that the charge to your payment card or the issuance of your invoice will occur when your order is dispatched.

Payments

We use Stripe (credit card) and PayPal on our international site.

Returns, Complaints, Replacement, Returns

100-Day Risk-Free Trial (100 days money back)

At Flowlife, you always have a 100-day risk-free trial, which means that from the date of purchase, you can test and use the product for 100 days and then return if you are unsatisfied. When using the Customer Satisfaction Guarantee, the full amount is always refunded. Flowlife also pays for shipping costs.

Return Policy

The product must be in salable condition with undamaged packaging. You have a general legislated 100 day right of withdrawal from the time you have received an item you ordered. When using the right of withdrawal, Flowlife stands for return shipping. When using the right of withdrawal, the entire amount is refunded.

GDPR

Link to our https://www.flowlife.com/eu/gdpr/

Dispute

In the event of a dispute, we follow the recommendations of the General Complaints Board.

Inflow AB

556962-1260

Luntmakargatan 90

113 51 Stockholm

hello@flowlife.com

Klarna Legal & privacy

Legal & privacy

When adding Klarna Checkout to your site, you need to consider:

- Data protection and data sharing aspects

- T&C information Please seek legal advice to ensure compliance with applicable regulations.

Data usage

Please note that in order for your use of personal data to comply with applicable laws, such as the GDPR and the E-Privacy Directive, you may not use any customer data provided through the Klarna integration before an order has been placed.

This includes, but is not limited to:

- Populating data fields outside the Klarna checkout iframe

- Creating user accounts before active consent has been given

- Any marketing purposes, including but not limited to abandon cart retargeting before the customer has finalized the purchase.

Customer data sharing

National and EU rules such as the GDPR sets certain limits to how and when you may share customer-identifying information with Klarna.

Privacy Notice (all markets)

If you share personal data with Klarna you need to explain this in your privacy notice and link to Klarna’s privacy notice there. Below is an example of what that could look like in your existing privacy notice (the specific data categories transferred to be added, and text to be translated into your local language):

“We use Klarna as the provider of our checkout. This means that we might transfer your personal data in the form of contact and order details to Klarna when the checkout is loaded, in order for Klarna to manage your purchase. Your personal data transferred is processed in line with Klarna’s own privacy notice.”

Addendum for Switzerland, when Billpay Invoice is offered through KCO

In Switzerland, Klarna offers the payment method Invoice through its subsidiary Billpay. If you share personal data with Klarna and Billpay to offer this payment method you need to explain this (in addition to the above) in your privacy notice and link to Klarna’s and Billpay’s local privacy notices there. Below is an example of what that addition could look like in your existing privacy notice (the specific data categories transferred to be added, and text to be translated into your local language):

Billpay’s/Klarna’s payment options: In order to be able to offer you Klarna’s payment options and to assess whether you qualify for their payment options and to tailor the payment options for you, we might in the checkout pass your personal data in the form of contact and order details to Klarna and Billpay. Your personal data is handled in accordance with applicable data protection law and in accordance with the information in Klarna’s [de, fr, it or en versions] and Billpay’s [de, fr, it or en versions] privacy notices.

Terms and Conditions

Ensure that your terms and conditions reflect your cooperation with Klarna, and that you comply with applicable laws.

Geo-blocking

Note that the information provided in this article is intended for general information purposes only and does not constitute legal advice, professional advice, or an opinion of any kind as to your individual needs. You are encouraged to seek the advice of a competent professional where such advice is required.

Purpose

The main purpose of the REGULATION (EU) 2018/302 is to prevent geo-discrimination of European customers when shopping online within the EU; setting different requirements for customers based on the country of residence.

Essence

Generally, it comes down to being able to shop like a local. This means equal order, payment and delivery options for both foreign (being other EU customers) and domestic customers when shopping online.

Scope

The regulation applies to B2C and B2B (provided that the B2B transaction is not based on an individually negotiated contract, but subject to general terms and conditions). All goods and services, including digital, are in scope, but there are exceptions and limitations.

Timeline

Came into force on December 3, 2018.

Guidance

Read about the regulation here.

Payment methods in the Checkout

All payment methods in Klarna Checkout and the way in which they are displayed to users will not be affected by the new regulation.

Example - You are a German merchant offering Klarna checkout in Germany. An Italian user wants to place an order on your site.

- You as a merchant don’t have to do anything. Klarna Checkout will show the payment methods relevant to the user.

Billing & Shipping

You have to allow any EU citizen to shop from your site, but you don’t have to ship to all EU countries. Where you ship to will not be affected by this regulation.

Example - You are a German merchant offering shipping within Germany only and have configured the checkout for separate shipping and billing. An Italian customer wants to place an order on your site. You are not allowed to restrict the Italian customer from placing the order but you are not obligated to ship outside of Germany. To solve for this situation, you need to add IT to Klarna Checkout via our country selector (IT is part of our Global/Extended market offer), or turn off separate shipping.

- Alternative 1 - Country selector for IT, read more here. This setup will solve the situation by giving users a country selector where they can choose Italy as their billing country. As the user moves to shipping address, you have the possibility to restrict country availability, read more about that here.

- Alternative 2 - Turn off separate shipping, read more here. By doing so, there will not be a separate shipping form under the billing form. The user will consider the address form to cover shipping. Given this setup, the Italian customer can now add their personal name, email and phone number, and a German shipping address.

New credit legislation - How you will be impacted

New legislation has been adopted by the Swedish Parliament stating that if both credit and debit payment options are offered by a merchant, the debit option(s) must be presented before the credit option(s) in the checkout. This law takes effect 1 July 2020.

Here’s what you need to know if you have the following payment & checkout options:

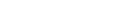

Klarna Checkout (KCO): No action required.

Klarna will take care of all the logic to ensure debit payment options are shown first.

Klarna Payments (KP) with no debit options: No action required.

You are only required to make sure a debit option is placed as the first option if you offer it as a payment method.

Klarna Payment (KP) with debit options: Action required.

As a merchant, you are in control of the order in which payment methods are organized inside your checkout and will need to take steps to comply with the new law.

Continue reading for more details on how KCO will be presented, and what actions we recommend if you have KP with debit options.

What the new law means

New legislation (Regeringens proposition) adopted by the Swedish Parliament will take effect on 1 July 2020, and will only be applicable to Sweden. The law sets requirements on the presentation of payment methods in online checkouts, enforcing debit payment options to be displayed before any credit payment options, if both are available.

Obligations in the new regulation apply to any parties who present or process payment methods. This includes: merchants, partners, and Payment Service Providers (PSP) like banks. To navigate the new changes, we’ve published guidelines, to help our merchants and partners to ensure compliance with the legal requirements.

What does this mean for me as a merchant?

The impact for you as a merchant will depend on what payment methods you offer and what checkout solution you use. The new legislation does not require merchants to provide debit payment methods, but does regulate how to present them in an online checkout if you do.

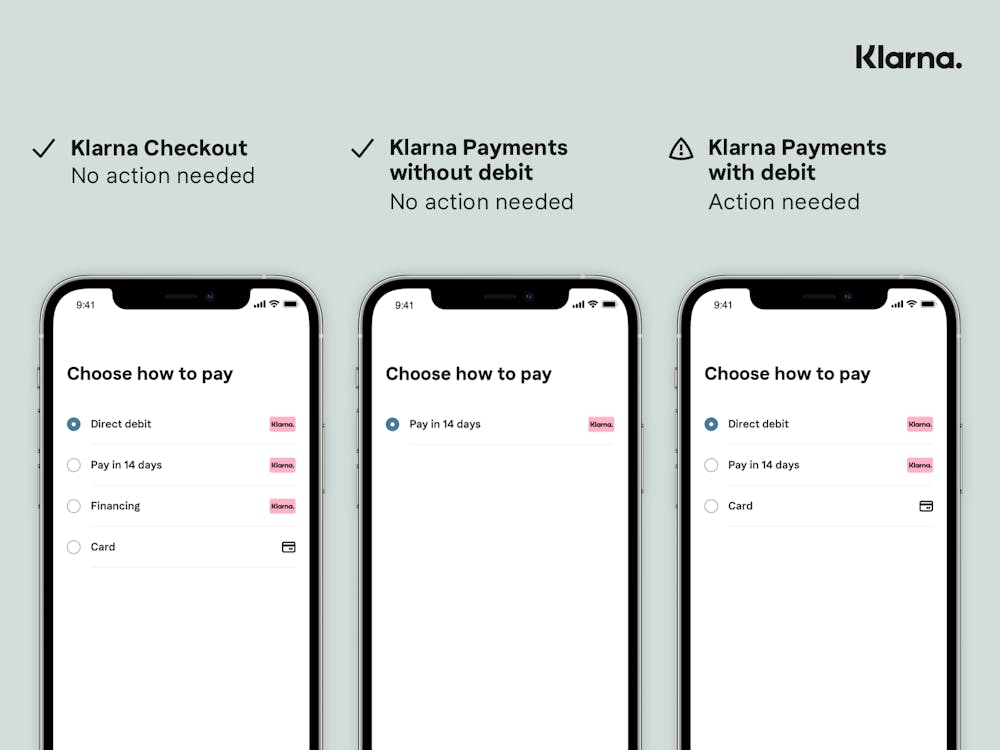

Below is an overview of Klarna payment methods, and how each categorizes in terms of credit or debit options.

What do I need to do to be prepared?

Merchants with Klarna Checkout (KCO v2 & v3)

No action needed. Klarna will update the current KCO solution for the Swedish market to make sure that the new legal requirements are followed. You will notice that debit payment methods such as Direct Debit, (when available), will be presented as the first option in your checkout.

Merchants with Klarna Payments (KP)

If you offer Klarna Payments in your checkout, Klarna cannot control the order or logic in which the payment methods are presented. Therefore, as a merchant you are solely responsible to ensure your checkout is compliant and lawful according to the new legislation before it enters into force (1 July 2020).

If you have Klarna Payments (KP) and multiple Klarna payment methods within the same widget then we will manage the logic of sorting these. If a debit payment option exists then that will be displayed first. Credit payment methods that include interest rate will always be displayed as the last option if others exist. If the multiple Klarna payment methods are placed in different widgets then we cannot control in what order they will be sorted.

Klarna will discontinue support of Klarna Payment Methods (KPM) as of September 2020. Action recommended.

Klarna will no longer be supporting KPM as of September 2020. For automatic updates (including legal compliance), we recommend all merchants move to Klarna Checkout (KCO) or Klarna Payments (KP). With KCO, Klarna will handle the sorting of payment methods for you. To migrate to KCO, you can use the self service flow that is available in the merchants portal (link). Please reach out to your Klarna account manager to get more information about pricing and how to transfer to Klarna Checkout or Klarna Payments.